Published 26th November 2018

In the bakery category, sprouted grains products continue to grow in USA making it a worthwhile expansion with key considerations to factor at product development. The consumption of sprouted grains has a number of positive health benefits making it a nutritious offering in the bakery segment.

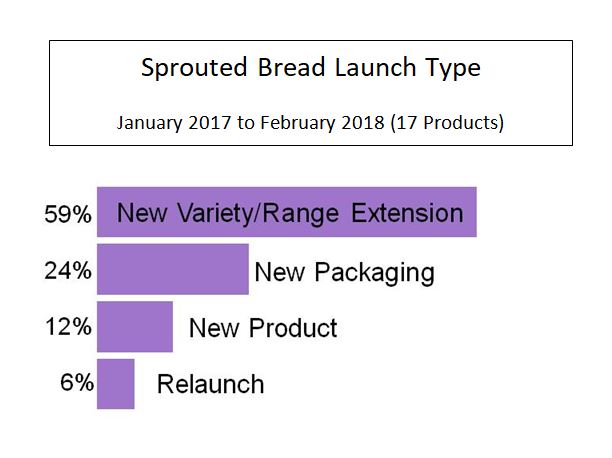

According to Mintel Global New Products Database (GNPD), of the 17 sprouted bread products launched from January 2017 to February 2018, 71% were either a new product or a variety/range extension. Manufacturers are noticing this growing momentum as they move into this space and by focusing on key product attributes during product development can capitalise on this trend.

There are some initial challenges needed to be considered when entering this new category. Due to the nature of the sprouting process from starch to simple sugars consumers may find the taste being nutty, malted or bitter. In addition, the shelf life is generally shorter which will impact on manufacturing baking schedules and supply chain. The move from the traditional shelf space to chilled/freezer section for extended shelf life may present more implications.

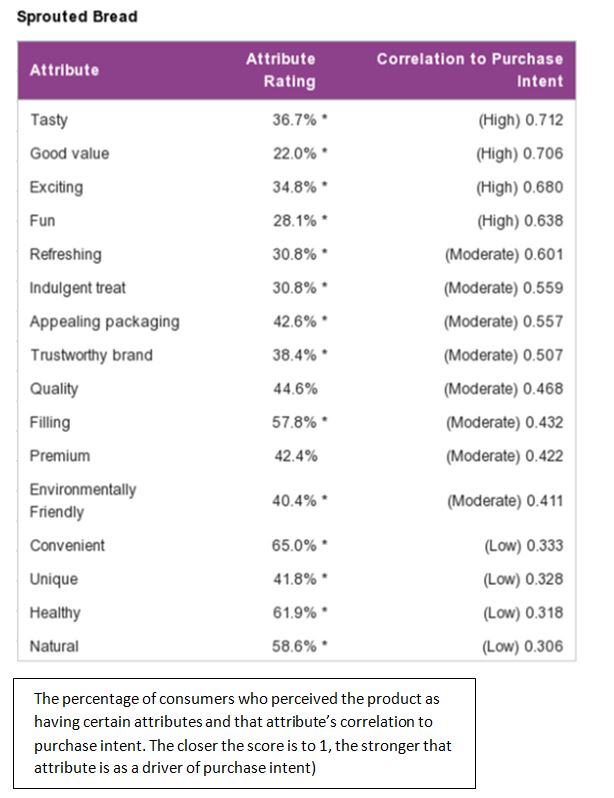

By combining GNPD with Mintel’s Purchase Intelligence data we are able to analyse how consumers perceive the sprouted bread based on specific attributes. Sprouted bread maintains its health halo with high natural and healthy attributes. On the other end of the scale consumers believe sprouted bread is lacking in taste, good value and excitement.

Digging deeper into Mintel’s Purchase Intelligence reveals how each perceived attribute correlate to purchase intent. Sprouted breads show strong natural and healthy attributes however reveal low purchase intent. While the following attributes Taste, Good Value, Exciting and Fun have high purchase intent with the lowest attributes. This provides the frame work on the main considerations in the expansion into the sprouted grain bakery market.

Looking ahead the main considerations to focus on during product development;

- Formulation development

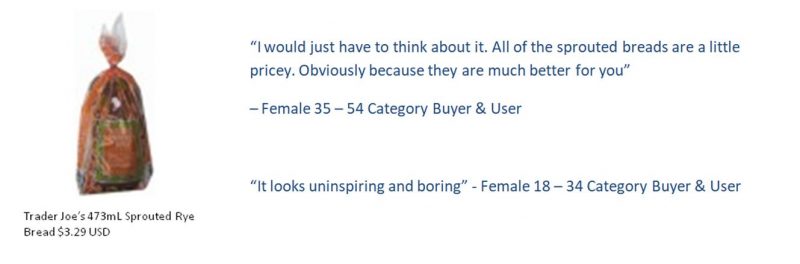

- Packaging / positioning

- Price strategy

Formulation development; identifying competitor products to bench mark and regular taste panels is fundamental during the development to win over consumers. Can the nutty/bitter taste be incorporated into the overall flavour profile in the finished product? Another strategy is the use of masking flavours for specific taste profiles (for example bitter) to cast a wider net of consumers.

Packaging / positioning has a key role to play for communicating to the consumer as it creates an immediate impression. As marketers look for new ways to attract consumers the attributes exciting / fun which has high purchase intent. Exploring new packaging materials such as thermoforming in rigid film to increase shelf life and differentiate from the current plastic LDPE on the market.

The last consideration is pricing strategy to capture the high purchasing attribute good value. Sprouted bread products shelf price is 16% higher than grain bread while being 4% less product weight. Providing good value requires a combination of shelf price and/or branding core values, this in turn will translate to good value options for the consumer. This could include extending the brand identity with the sprouted bread launch under the brands name umbrella enabling the strengths of one product to influence consumers attributes of another.

As the sprouted bread category in USA develops, manufactures and brand owners need to focus on key attributes during the new product development process to capitalise on this growing trend.